Connected Car Insurance: Developments in the Connected Mobility Market

Innovation

Technology

Consulting

Home » Connected Car Insurance

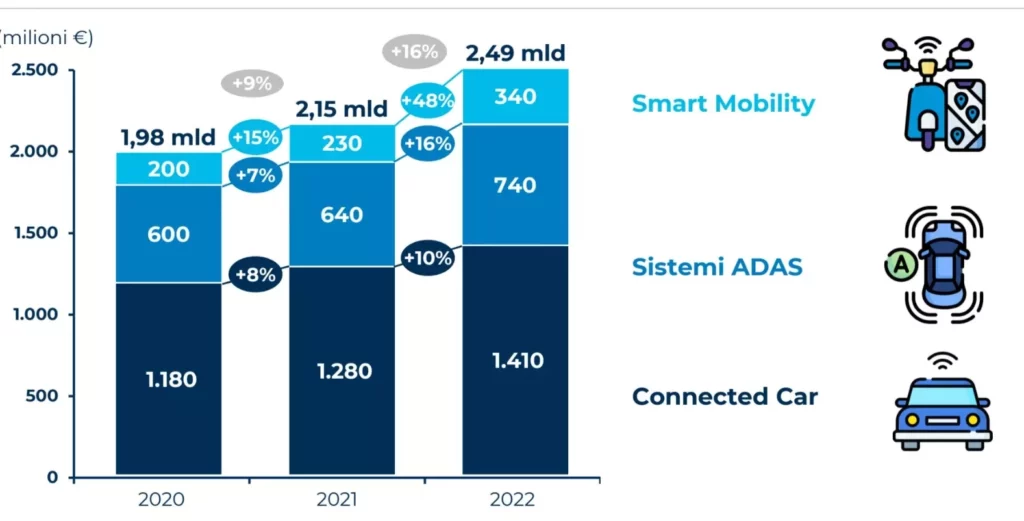

By 2022, the Connected Car & Mobility market in Italy reached a value of €2.5 billion, marking a 16% increase compared to 2021, according to research by the Connected Car & Mobility Observatory of the Politecnico di Milano.

Key Figures

- Connected car solutions account for €1.4 billion (+10% year-over-year).

- Advanced Driver Assistance Systems (ADAS)—such as automatic emergency braking and lane-keeping systems—represent €740 million (+16%).

- Smart mobility solutions in urban areas, including parking management and shared mobility, reached €340 million, with a 48% increase.

The adoption of connected vehicles is also rising: by the end of 2022, 19.7 million connected cars were on Italian roads—one in every two vehicles, or one for every three inhabitants.

ADAS in Europe

The demand for ADAS in Europe has been accelerated by EU regulations, which made these features mandatory in all new vehicles starting in 2022. Connected cars now serve as platforms for value-added services that can be unlocked for a fee—for example, extending the battery life of an electric vehicle.

Connected cars provide significant benefits, including fleet monitoring, responsible driving, and predictive maintenance. Large-scale projects like ANAS’s smart roads initiative are paving the way for enhanced road efficiency, vehicle electrification, and assisted driving.

The Role of Black Boxes

Black boxes, or telematics devices, collect data on driving behavior and accidents. This information helps in claims processing and allows insurers to calculate more personalized premiums based on real-world driving metrics.

The most widespread solutions are GPS/GPRS boxes, used to track vehicles and record driving data for insurance purposes. There are now 10 million such devices in use in Italy, up 4% from 2021.

However, market growth is largely driven by natively connected vehicles (i.e., with integrated SIM cards), which now total 4.3 million—a 21% increase year-over-year.

Meanwhile, data-driven services offered by connected vehicles have generated revenues of €480 million, growing by 20% compared to 2021.

Conclusion

The rise of connected mobility and the use of black boxes are transforming the insurance landscape. Thanks to real-time data and advanced technologies, insurers can offer tailored policies and dynamic premiums based on individual driving behavior and vehicle performance.

Connected cars not only enhance road safety but also improve fleet management, maintenance planning, and operational efficiency.

Companies like Frontiere are at the forefront of this transformation. Their Pay Per Mile service, for example, analyzes trip data to generate customized insurance policies—offering innovative solutions for insurers, consumers, and fleet managers alike.

Connected mobility is not just a trend—it’s the foundation for a smarter, more sustainable future.

Indice

Iscriviti alla newsletter

Indice

Iscriviti alla newsletter

Get more information

Home » Connected Car Insurance