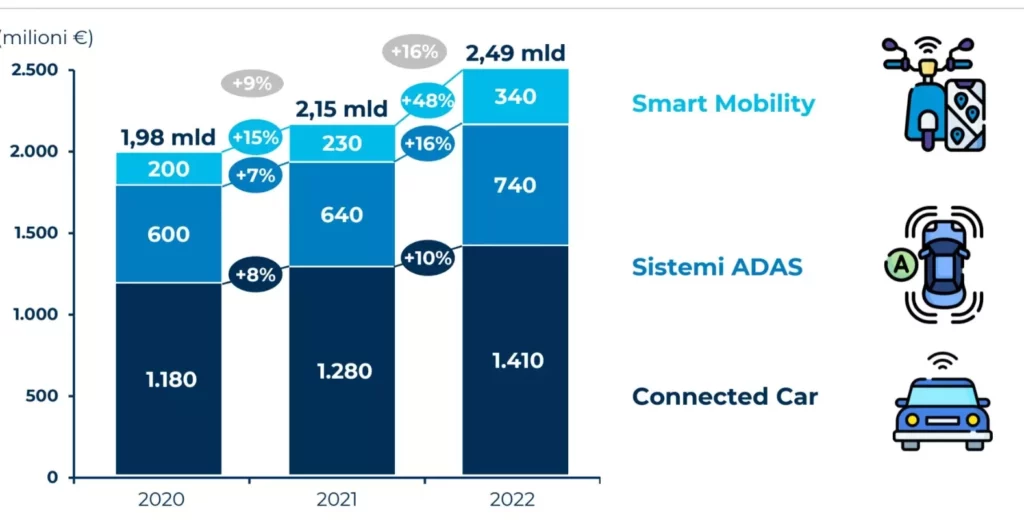

By 2022, the Connected Car & Mobility market in Italy has reached a value of 2.5 billion euros, +16% compared to 2021, according to research by the Connected Car & Mobility Observatory of the Politecnico di Milano.

Demand for ADAS in Europe has been spurred by European legal requirements, making these devices mandatory in new vehicles from 2022. Connected cars are to date a conduit for innovative services and features that can be unlocked for a fee, such as extending the battery life of an electric car.

Connected cars offer numerous benefits, such as fleet monitoring, responsible driving, and scheduled maintenance. Smart road projects, such as ANAS's, improve road efficiency, from electrification to assisted driving.

Black boxes, or telematics boxes, are devices that record data on driving and accidents, facilitating recovery and providing information on driving style. Insurance companies use them to calculate more accurate premiums based on information regarding vehicle safety.

The most popular solutions today are Gps/Gprs boxes for tracking and recording driving parameters for insurance purposes (10 million, up 4 percent from 2021), but growth is mainly driven by natively connected cars via sim (4.3 million, up 21 percent). More and more companies are also able to collect large amounts of data from vehicles: services in this area reach 480 million, +20% compared to 2021.

In conclusion, the evolution of connected mobility and the use of black boxes are transforming the insurance market. With collected data and advanced technologies, insurance companies can offer customized policies and more accurate premiums based on driving style and vehicle safety. Connected cars not only improve road safety, but also fleet management and scheduled maintenance. With innovative solutions like those offered by Frontiere, connected mobility opens up new opportunities for insurers, consumers, and fleet managers, redefining the future of mobility.

Frontiere offers connected mobility solutions, including its Pay Per Mile service, which analyzes trip data and generates customized policies.

When we think of Sharing Mobility we naturally think of a car, a scooter, a bike, a van or a scooter. Wouldn't it be nice to enjoy a smart and fast solution for renting a dinghy as well?

There is a way to enjoy sharing mobility even on vacation and it is called E-Sea-Sharing! A sea of freedom all Made in Italy - write Giuseppe Labate and Claudio Fiumara, CEO and COO respectively of the parent company of the world's first boat sharing service, designed and developed to meet the needs and desires of all those travelers who want to experience the sea.

Thanks to a dedicated App, E-sea sharing allows people to quickly rent their dinghy: just search for the nearest port and start the rental at any time. The service is currently available on the Emerald Coast and will soon land in the Cinque Terre, the Aeolian Islands and the Amalfi Coast.

It is, therefore, a project that highlights the new concept of sharing mobility of the sea.

The innovative platform is tailor-made and reflects the specifications necessary for the delivery of the service by E-Sea Sharing itself. The App is currently available on the Apple Store and Google Play Store.

We met with the star-up's COO Claudio Fiumara and, of course aboard an inflatable boat from the E-SEA-Sharing fleet, asked him how the idea came about and what the actual benefits are for travelers.

The innovative start-up was born in 2020 from the vision of two young entrepreneurs with a passion for the sea and technology who decided to bring these two worlds together to give boating a new look and bring it closer to the most advanced land-based mobility systems.

Giuseppe has always cultivated his passion for the sea by working with charter companies and running a tourist marina. Claudio, on the other hand, an environmental and territorial engineer and Ph.D., is a founding partner of a university spin-off and is constantly researching innovative projects. The two, following the forced stop caused by the lockdown, thus decided to form E-Sea Sharing with the aim of revolutionizing and industrializing the process of nautical leasing by launching boat sharing on the market.

The benefits offered to the customer are many and respond to the need for easy, fast, affordable sea travel, overcoming the limitations inherent in the currently existing options.

First, the service allows anyone to have access to an opportunity that until now has been reserved for the few, due to the high cost and objective difficulties involved in owning a boat.

The vessels, being equipped with 40-hp engines, can be used even by those who do not have a boat license. Vessels are always available, geolocated and identified by means of a mobile application, which makes it particularly easy to use the service. This allows the customer to be totally free to sail, at any time, to any route, and to release the vessel even in a different port than the one of departure.

Compared to traditional rental, E-Sea Sharing offers payment, contactless and cachless, even by the minute, so that the customer can decide to pay only for actual use.

All of this is done autonomously, without having to contact a boat owner, making boating a 360-degree experience and offering even the less experienced a chance to experience the unmooring and mooring of a vessel.

The service is monitored remotely through technological devices that aim to increase safety at sea, both for the customer and for other boaters.

E-Sea Sharing is a highly innovative and unique project in italy: helping the startup build the sharing platform, starting from our full suite of shared mobility solutions, was an exciting challenge.

Go E-Sea Sharing!

The technological evolution represented by the combination of Internet of Things (IoT), Artificial Intelligence (AI), and Automation has proven to be a winning bet in several industries. In the insurance field, particularly in Insurance Telematics, these emerging technologies offer unprecedented opportunities to improve efficiency, reduce costs and provide better service to customers.

We recently interviewed our own Marco D'Ambrosio on the topic, who provided us with a broad and comprehensive overview of why to take a specific approach and the resulting benefits for companies that choose to integrate these three technologies.

"Disruptive" is the adjective I use most often to qualify the approach that Insurance Telematics offers to risk management in the insurance industry, bringing benefits to both companies and customers. The integration of IoT, Artificial Intelligence and automation creates new opportunities for improving efficiency, reducing costs and offering personalized service. Insurance companies that adopt these innovative solutions will be able to remain competitive and provide added value to their customers in an ever-changing market.

My dispassionate suggestion, for anyone who feels like embarking on a path of business innovation, is to contact us. At Frontiere, we are constantly working to facilitate access to innovations in all market sectors and, therefore, to innovative business models. It is the principle that has always guided our research and development and that makes our approach to smart mobility and risk management in the insurance industry disruptive.