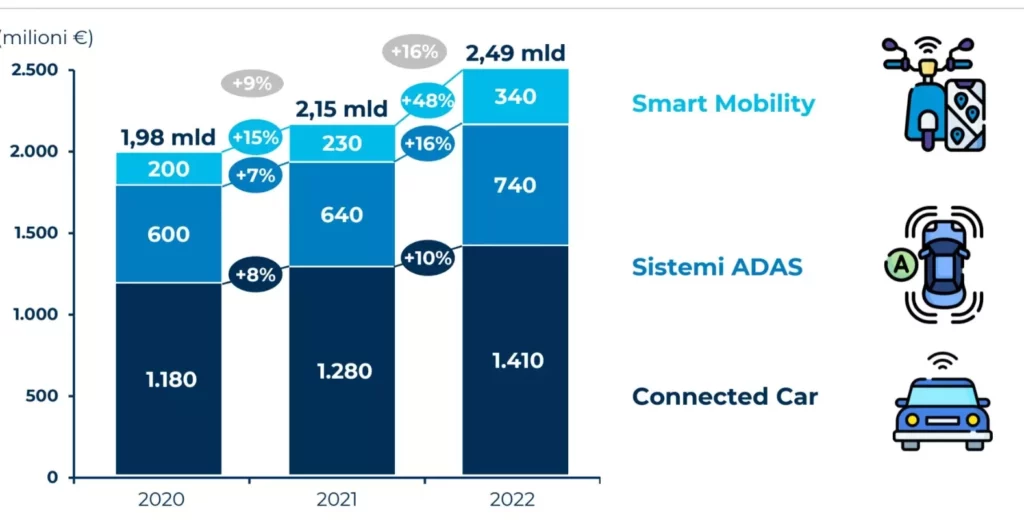

By 2022, the Connected Car & Mobility market in Italy has reached a value of 2.5 billion euros, +16% compared to 2021, according to research by the Connected Car & Mobility Observatory of the Politecnico di Milano.

Demand for ADAS in Europe has been spurred by European legal requirements, making these devices mandatory in new vehicles from 2022. Connected cars are to date a conduit for innovative services and features that can be unlocked for a fee, such as extending the battery life of an electric car.

Connected cars offer numerous benefits, such as fleet monitoring, responsible driving, and scheduled maintenance. Smart road projects, such as ANAS's, improve road efficiency, from electrification to assisted driving.

Black boxes, or telematics boxes, are devices that record data on driving and accidents, facilitating recovery and providing information on driving style. Insurance companies use them to calculate more accurate premiums based on information regarding vehicle safety.

The most popular solutions today are Gps/Gprs boxes for tracking and recording driving parameters for insurance purposes (10 million, up 4 percent from 2021), but growth is mainly driven by natively connected cars via sim (4.3 million, up 21 percent). More and more companies are also able to collect large amounts of data from vehicles: services in this area reach 480 million, +20% compared to 2021.

In conclusion, the evolution of connected mobility and the use of black boxes are transforming the insurance market. With collected data and advanced technologies, insurance companies can offer customized policies and more accurate premiums based on driving style and vehicle safety. Connected cars not only improve road safety, but also fleet management and scheduled maintenance. With innovative solutions like those offered by Frontiere, connected mobility opens up new opportunities for insurers, consumers, and fleet managers, redefining the future of mobility.

Frontiere offers connected mobility solutions, including its Pay Per Mile service, which analyzes trip data and generates customized policies.